A Biased View of Mortgage Broker Salary

Wiki Article

See This Report on Mortgage Broker Assistant

Table of ContentsBroker Mortgage Rates - The FactsThe 2-Minute Rule for Mortgage BrokerageRumored Buzz on Broker Mortgage RatesEverything about Broker Mortgage MeaningThe 20-Second Trick For Mortgage Broker SalaryMortgage Broker Association Can Be Fun For Anyone

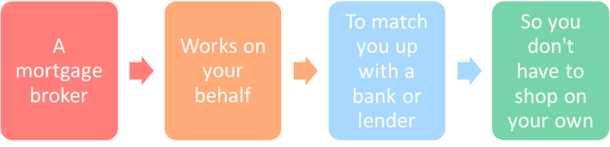

The home mortgage broker's work is to recognize what you're attempting to accomplish, work out whether you are ready to leap in currently and after that match a lending institution to that. Prior to speaking regarding lenders, they need to gather all the information from you that a financial institution will certainly need.

A major adjustment to the market happening this year is that Home mortgage Brokers will have to follow "Ideal Rate of interests Duty" which suggests that lawfully they have to put the customer. Interestingly, the financial institutions don't need to adhere to this new policy which will profit those clients making use of a Home mortgage Broker even extra.

Our Mortgage Broker Association Statements

It's a mortgage broker's job to aid obtain you ready. It might be that your cost savings aren't rather yet where they should be, or maybe that your earnings is a bit questionable or you've been freelance as well as the financial institutions require even more time to analyze your scenario. If you're not yet all set, a mortgage broker exists to outfit you with the knowledge and guidance on exactly how to boost your placement for a funding.

Your home is your own. Written in partnership with Madeleine Mc, Donald - Mortgage broker.

The Single Strategy To Use For Mortgage Broker Vs Loan Officer

They do this by contrasting home mortgage items provided by a variety of lending institutions. A home mortgage broker functions as the quarterback for your financing, passing the round in between you, the customer, and the lending institution. To be clear, home loan brokers do a lot more than assist you get a straightforward home loan on your home.When you most likely to the financial institution, the bank can just offer you the items and services it has offered. A financial institution isn't likely to inform you to decrease the street to its rival who offers a home mortgage product much better fit to your needs. Unlike a financial institution, a mortgage broker frequently has relationships with (sometimes some lenders that don't directly manage the public), making his opportunities that much far better of finding a lender with the most effective home mortgage for you.

If you're aiming to re-finance, access equity, or obtain a second home loan, they will certainly call for details about your current fundings currently in position. As soon as your home mortgage broker has a good concept concerning what you're seeking, he can focus on the. Oftentimes, your home loan broker may have practically whatever he needs to wage check over here a home loan application at this moment.

The Main Principles Of Mortgage Broker

If you have actually currently made an offer on a property and it's been approved, your broker will certainly submit your application as a live offer. As soon as the broker has a mortgage dedication back from the lender, he'll go over any kind of problems that require to be satisfied (an assessment, evidence of income, proof of deposit, and so on).This, in a nutshell, is how a home mortgage application works. Why use a mortgage broker You might be asking yourself why you ought to make use of a mortgage broker.

Your broker needs to be well-versed in the home mortgage products of all these lending institutions. This indicates you're most likely to discover the very best home mortgage item that suits your requirements. If you're a private with broken credit report or you're purchasing a residential property that's in less than stellar problem, this is where a broker can be worth their king's ransom.

The Greatest Guide To Broker Mortgage Meaning

When you go shopping on your own for a mortgage, you'll need to request a mortgage at each lender. A broker, on the various other hand, should recognize the lenders like the back of their hand as well as ought to be able to focus in on the lending institution that's best for you, conserving you time and also shielding your credit history from being lowered by using at also numerous loan providers.Make certain to ask your broker the number of loan providers he handles, as some brokers have accessibility to more lending institutions than others and also might do a higher quantity of service than others, which means you'll likely original site obtain a far better rate. This was an overview of functioning with a mortgage broker.

85%Promoted Rate (p. a.)2. 21%Comparison Rate (p. a.) Base standards of: a $400,000 lending quantity, variable, fixed, principal as well as rate of useful source interest (P&I) house car loans with an LVR (loan-to-value) ratio of at the very least 80%. The 'Contrast House Loans' table allows for computations to made on variables as selected and also input by the individual.

Getting My Mortgage Broker Salary To Work

The choice to using a home loan broker is for people to do it themselves, which is often described as going 'direct'. A 2018 ASIC survey of customers who had secured a funding in the previous 12 months reported that 56% went direct with a lender while 44% went via a mortgage broker.Report this wiki page